Defining the problem: A Journey from the Natural World to Human Global Influence

Life on Earth has flourished through countless millennia, evolving from simple organisms into a complex biosphere teeming with diversity. However, this balance began to shift with the evolution of humans. As humans advanced, they constructed a new world atop the old, natural one, drastically altering the planet’s landscape, atmosphere, and ecosystems as they shaped the world to their needs.

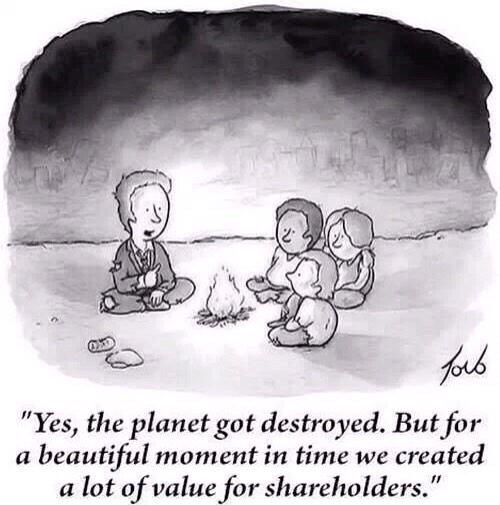

Today, human activities are dramatically changing the climate and drive what many scientists consider the sixth mass extinction of biodiversity. In Earth’s history, massive volcanic traps have caused such extinction events and typically used millions of years to make full-blown climate catastrophes unfold. One of these, the Permian-Triassic extinction event, killed off about 95% of all species, almost forcing life on Earth to it’s knees. While this sounds frightening, humanity’s industrial and technological endeavors over just a few hundred years are precipitating an environmental catastrophe at an unprecedented pace, mimicking the destructive power of historical volcanic activity. What used to take millions of years with continuous eruptions from volcano traps has been “accomplished” by humanity in the course of a few generations. Human society is now like a full-blown volcano trap and we won’t stop unless we stop ourselves.

The Role of Financial Institutions in the Sustainable Transition

Having established the need for transition, let’s look at the role of the financial sector.

Banks and financial institutions have long directed capital towards impactful projects. They are the “gatekeepers” of capital, responsible for channeling the funds towards its most productive use. Today, these entities are pivotal in financing the sustainable transition of human society. By aligning capital allocation with sustainable practices, these institutions can lead the shift towards a modern, sustainable economy.

So financial institutions might allocate capital to drive sustainable transition in the most effective manner, but what exactly should they seek to change?

In a world that is yet to be fully sustainable, financial decisions often involve significant trade-offs. Stakeholders must evaluate the environmental and social returns of their investments, posing difficult questions, such as the value of reducing carbon emissions against the ethical implications of labor practices. Arguably, there is a pressing need for a government-defined framework to guide these decisions, ensuring they align with democratically elected principles rather than the interests of a capital elite.

Rethinking Value Creation and Distribution

So if we know what sort of returns to pursue, and we know to price those returns, how do we really measure them and who should benefit from the returns? Let’s first lift it one level up at the societal level:

Gross Domestic Product (GDP) has been the traditional measure of economic activity but fails to account for environmental and social value destruction. GDP also fails to measure how well the value is “sticking around” and contributes to the well-being of those that come after us. Sustainable financing recognizes that protecting these values is not just ethical but economically sensible. Financial institutions is currently embarking on their journey to “count everything that counts” with their evolving ESG reporting practices.

Let’s also expand a bit on the aspect of fairness. The benefits of unsustainable economic activities typically accrue to the initiators or owners in terms of financial returns, while the environmental and social costs are borne by society at large, often distributed at random with little or no regards for what is fair. This disparity highlights the need for a more equitable distribution of both created and destroyed values – once we know how to count or quantify them.

Financial institutions must adopt comprehensive sustainability reporting, accounting for all impacts — unlike the current GDP model at societal level. They should also be credited not only for reducing emissions or other footprints within their portfolios but also for investing in high-emission or dirty industries and driving them towards cleaner and better practices, causing changes in the real economy. This approach prevents the segregation of ‘dirty’ and ‘green’ sectors and fosters inclusive, holistic change across all industries.

One major challenge, however, is that ESG (Environmental, Social, and Governance) data remains underdeveloped, often leading to inconsistent and incomparable metrics across different entities. Stakeholders should scrutinize these figures critically, recognizing that both ESG measurments and ESG improvement in general is a journey that needs to be accelerated to mitigate the ongoing environmental crisis and minimize the impacts of the ongoing sixth mass extinction.

Historical Lessons and Future Pathways

The near-catastrophic depletion of the ozone layer by CFC gases in the 70’s and 80’s and the solution forged by the Montreal Protocol is a testament to humanity’s ability to unite and solve global challenges. The recovery of the ozone layer is a beacon of hope, illustrating that concerted global efforts can reverse environmental damage. This historical success story should inspire current and future actions to keep humanity on the positive side of history.

In all, the interdependencies among environmental stability, ethical financial practices, and equitable social systems are clear. By understanding these connections and acting upon them, we can forge a path toward a sustainable and thriving planet for future generations. The role of finance is not just to fund the present but to invest in a livable, equitable future.